uber eats tax calculator australia

The Free DriveTax Uber Logbook Spreadsheet is the easiest way to track your kilometres and it does all the adding up and calculates your percentage for you. Here are some fees and factors that can.

Spreadsheet Income Calculator Uber Lyft Taxis Doordash Etsy Uk

Your annual Tax Summary should be available around mid-July.

. Order food online or in the Uber Eats app and support local restaurants. It provides a detailed breakdown of your annual earnings and business-related expenses that may be deductible. Your tax savings will grow and at the end of each.

This calculator is created to help uber drivers. You can find tax information on your Uber profile well provide you with a monthly and annual Tax Summary. Uber Eats Australia Food Delivery and Takeaway Order Online from.

With our tool you can estimate your Uber or Lyft driver taxes by week month quarter or year by configuring the calculator below based on how much and how often you plan to drive. Weekly Fortnightly Monthly Quarterly. For purposes of this tax calculator just use the total money you actually received from Uber for the year.

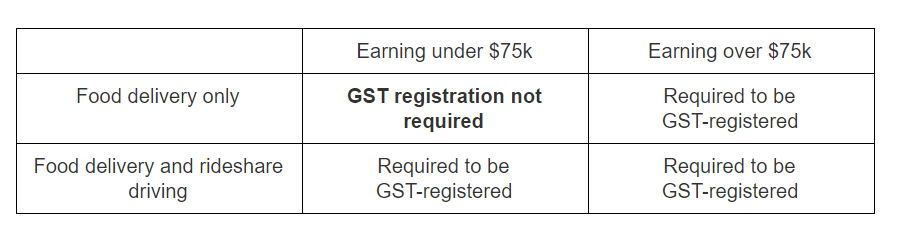

Find out here if you need to pay GST for Uber Eats deliveries. Please provide income and Expenses to get the right calculation. Driver Output Tax Liability b 909.

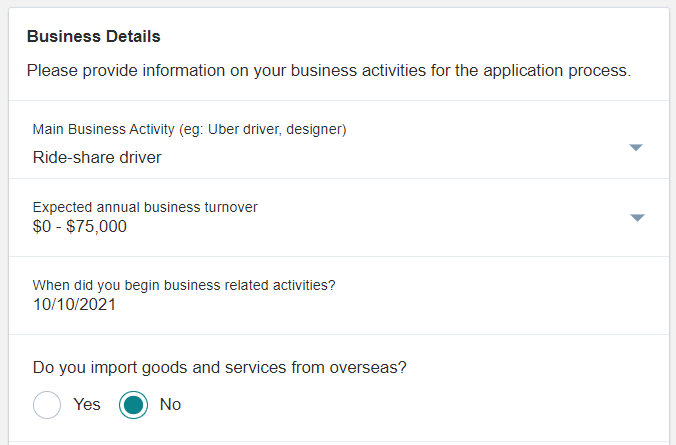

The tax year runs from 6th April to 5th April unlike the financial. The DriveTax FREE Uber Spreadsheet is the ultimate all-in-one tool for Uber Drivers to manage their taxes. UBER OLA Taxify GST and TAX calculatorThe aim of this calculator is to provide tax estimation based on your driving date and quarterly income.

After you enter those two things youll see two numbers. If you work as an Uber driver youll have to pay tax on the money you make from driving if you earn over 1000 in a tax year. Log in to your Uber account Once logged in navigate to the dashboard menu by clicking your nameicon in the top right.

The above rates include the Medicare Levy Each time you get paid from driving put that percentage aside. Please select Income Type. If you work as a delivery driver for a food delivery service like UberEats or Deliveroo any money you earn is considered assessable income which youre required to report in your.

Any money you make driving for Uber counts as income meaning you must. In others you will see an estimated fare range. So for example if you earn 30000 from your employee job and you have 5000 of Uber profits for the financial year your Uber profit will be taxed at 21 thats the rate above of 19 the.

Calculate the tax on your income from Uber Ola DiDi UberEats Menulog Deliveroo. How prices are estimated In most cities your cost is calculated up front before you confirm your ride. Average Uber Delivery Driver hourly pay in Australia is approximately 2724 which meets the national average.

From the dropdown menu select Partner earnings. Your tax summary is an Uber-generated tax document. To Calculate UBER GST using ALITAX.

Uber Tax Explained The Ultimate Guide To Tax For Uber Rideshare

Uber Tax Explained The Ultimate Guide To Tax For Uber Rideshare

Uber Tax Explained The Ultimate Guide To Tax For Uber Rideshare

The Uber Eats Business Model 2022 Update Fourweekmba

Uber Tax Information Essential Tax Forms Documents

Uber Gst Calculation In Australia Youtube

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Uber Eats Lies About Tip Percentages Almost Doubling What The Percentage Says It Is I Understand To Some Drivers The Tips Are The Most Important Part Of Their Income And They Need

Tax For Ubereats Food Delivery Drivers Drivetax Australia

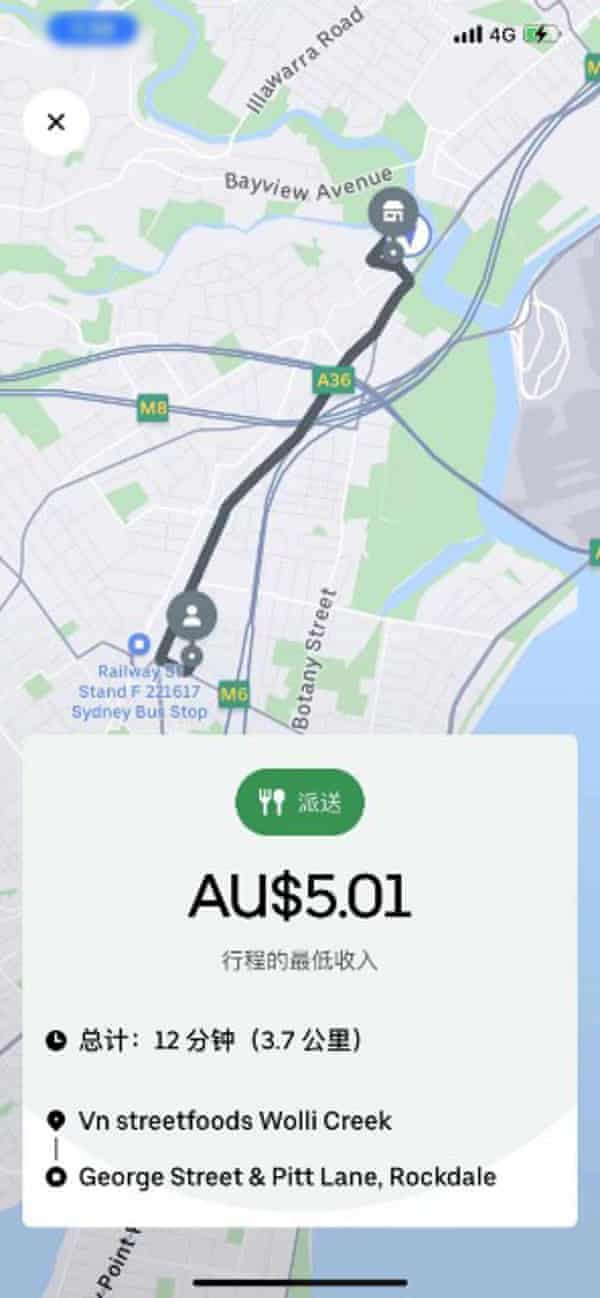

Uber Eats Riders Earning As Little As 5 For Deliveries Crossing Multiple Nsw Suburbs Uber The Guardian

Ubereats Tax Return Deductions Uber Drivers Forum

Deliveroo Tax Guide One Click Life

Delivery Partner Fares Rates Earnings Explained

Tax Information For Driver Partners

Uber Tax Explained The Ultimate Guide To Tax For Uber Rideshare

My Uber Income Income App For Uber Drivers In Australia

A Comprehensive Tax Compliance Guide For Food Delivery Drivers Including Ubereats Deliveroo Doordash Menulog And More Airtax Help Centre

A Comprehensive Tax Compliance Guide For Food Delivery Drivers Including Ubereats Deliveroo Doordash Menulog And More Airtax Help Centre